Fintech Services and Their Future!

Jan 29, 2022 - 5 MINS READ

FinTech Tree: A Simple yet Reliable Way to Get In-Depth Knowledge about Fintech Services and Their Future!

The new trends in technology have given human lives an about-turn. It was not long ago that the main focus of money transactions was cash and cheques. Besides, the FinTech trends have added more to the convenience list. Although FinTech is not all about products, markets, consumer or competition perspective. Instead, there are other disruptions related to the same. These disturbances are often overseen and can affect the entire chain of FinTech services and thus are crucial to focus on.

FinTech services have great revolutionized in the past few years. Besides, the efficiency of the customers, customer experience, novel business models, value chains, etc. plays a significant role. Further, many often forget to notice the challenges and obstacles that might come across in the journey of the customers. FinTech services are all about easing the entire process for the customer. The more the risks are associated, the more investors and customers stay away from it. And thus it’s crucial to ensure that the risks associated with the financial systems are low and are easy to cope with any change.

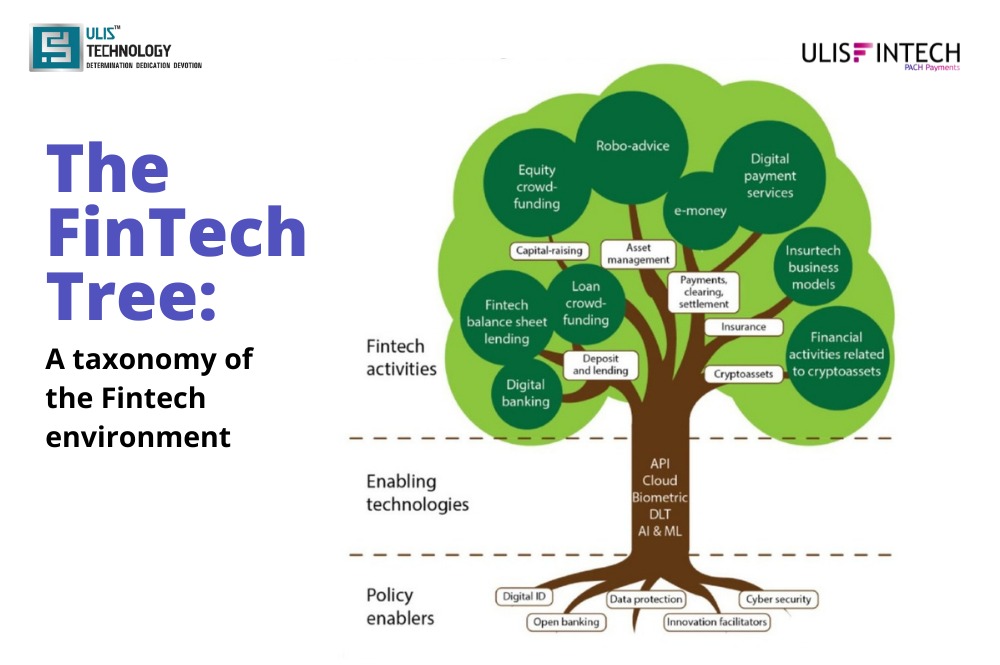

To understand this concept better, the concept of “FinTech Tree” is introduced. It is a novel framework that helps understand different categories of the regulatory sides of the FinTech revolution. Let’s see what these categories are in brief.

The initial one is “FinTech Activities”. There is a myriad of FinTech activities that can take different forms and can be executed in various ways. These include digital payment services, e-money, financial crypto assets, digital banking, loan, crowdfunding, and many more. All these activities mark as the topmost category as all these services are flexible enough to be performed in different sectors of the financial industry.

The second one is “Enabling Technologies”. The section marks the most crucial innovations that make all the FinTech services and activities more secure, and easy to go. And thus, it can be considered as the backbone or the supporting system of FinTech services. It includes all the recent innovations like Artificial Intelligence, Machine Learning, Cloud Computing, and other innovative trends that make the entire process much simpler.

The third and the last one is the “Policy Enablers”. These Mark the roots and the most crucial systems of the entire FinTech services-related journey. It includes all digital entities, innovation hubs, regulatory bodies, etc. that guide the FinTech systems. All these support the development of FinTech activities and ensure the secure use of enabling technologies.

Although, to date, the system has not yet faced the major risks the upcoming time will not be the same. Witnessing the pace of recent innovations, and managing the traditional scope of the financial services the risks associated with the FinTech solutions and their implementations are expected to be doubled. Further, the new topics coming into the limelight like decentralized Defi systems are more likely to become the center of the debate. And thus, it’s vital to manage with the proper planning and management. The future of FinTech solutions has a lot to explore and hence it’s essential to keep a keen eye on all aspects to avoid any major hurdles in the way.